Is Workers’ Compensation Taxable in California?

Workers’ compensation provides essential financial support for injured employees, but many wonder how these benefits affect their taxes. You might be asking: Is workers’ compensation taxable in California?

No, workers’ compensation benefits in California are not taxable. These benefits are federally exempt from taxation because they are designed to help employees cover expenses during recovery from a work-related injury or illness.

With decades of experience assisting injured workers, I’ve helped countless clients understand how workers’ compensation impacts their finances. Let’s explore why these benefits are tax-free and what this means for your recovery.

Are Workers’ Compensation Benefits Taxable?

The short answer is no—workers’ compensation benefits are generally not taxable at the federal or state level. According to the Internal Revenue Service (IRS), these benefits are exempt from being counted as taxable income. This tax exemption applies to benefits received under workers’ compensation acts, as well as statutes in the nature of workers’ compensation laws.

The General Rule of Non-taxability

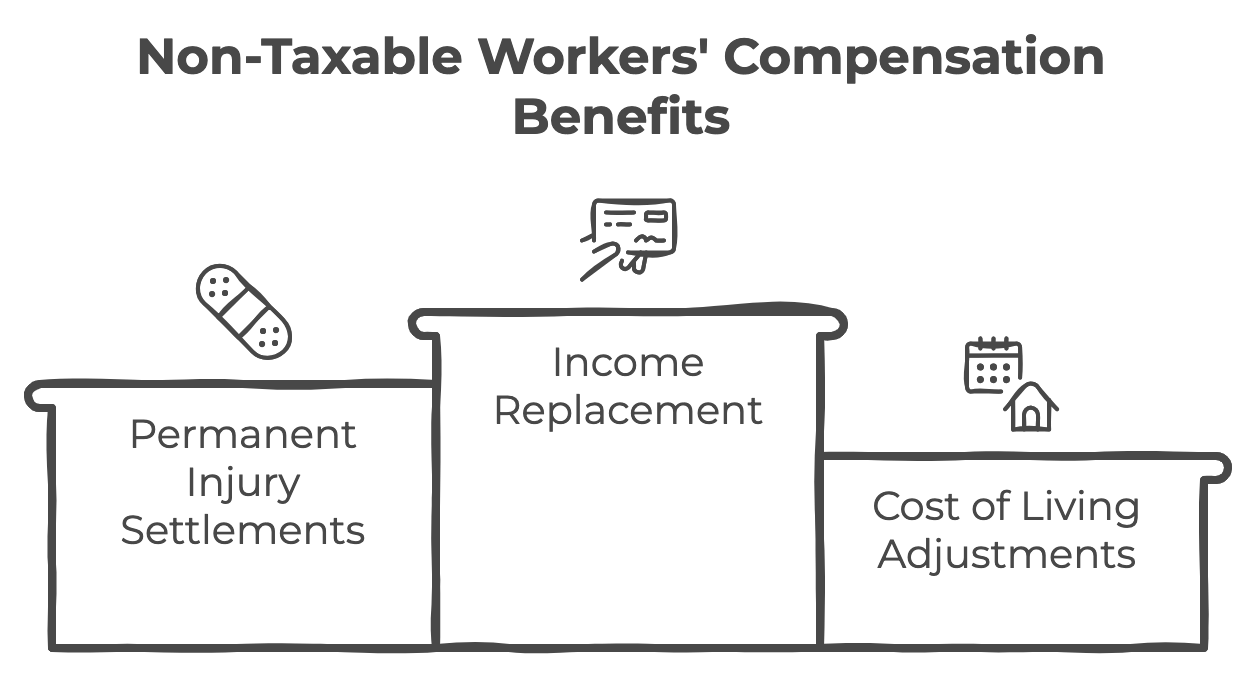

The IRS has clear guidelines regarding the non-taxable nature of workers’ compensation:

- Income Replacement: These benefits are specifically designed to replace lost wages due to a work-related injury, making them exempt from taxation.

- Permanent Injury Settlements: Lump-sum settlements for permanent injuries or impairment are also not taxable.

- Cost of Living Adjustments (COLA): Any adjustments received to cover living costs may also remain untaxed.

Exceptions to the Rule

While the tax-free nature of workers’ compensation is the general rule, there are nuanced exceptions where taxes could be applicable:

Social Security and Workers’ Compensation Offset

If you receive both workers’ compensation and Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), your Social Security benefits might be reduced due to a legal provision known as an “offset.” In such cases, part of your workers’ compensation could indirectly become taxable:

- Taxable Portion of SSDI/SSI: If your workers’ compensation benefits reduce your Social Security benefits, then the taxable component of your Social Security payments might increase, depending on your total income.

- Calculating Tax Impact: This depends on your total income and how it interacts with other benefits you receive.

Managing Your Financial Future

Understanding the tax implications of workers’ compensation is crucial for financial planning. Here are some steps to consider:

- Consult a Tax Professional: When navigating complex tax situations, expert advice is invaluable. A qualified tax professional can help ensure you comply with all tax requirements while maximizing your benefits.

- Understand Your Benefits Package: Keep detailed records of your workers’ compensation benefits received and any other income. This helps in accurate tax reporting when filing returns.

- Plan for Potential Offsets: If you receive multiple types of benefits, ensure you understand how they interrelate, particularly when it comes to potential SSDI or SSI offsets.

Conclusion

Navigating the financial waters after a workplace injury is challenging. Understanding the taxation rules for workers’ compensation can provide peace of mind and clarity in an otherwise confusing time. Remember, while workers’ compensation benefits are generally not taxable, exceptions exist. Planning ahead and seeking professional advice are key to optimizing your financial health post-injury.

Take Control of Your Recovery and Financial Future Today

When workplace injuries disrupt your life, you deserve clear answers and dedicated support. At Scher, Bassett & Hames, we’re here to help you make sense of your workers’ compensation benefits and ensure you’re maximizing every opportunity to secure your financial well-being.

Call 408-739-5300 now or visit ScherandBassett.com to schedule a Free No-Obligation Consultation. Let our experienced team handle the complexities, so you can focus on healing and moving forward with confidence. Your recovery starts with the right guidance—contact us today!

Related Content: