Financial Planning for Injured Workers

Introduction

In the wake of an unexpected injury, navigating the financial landscape can be daunting. Financial stability is often compromised due to medical expenses, lost wages, or incapacity to work. It’s crucial for injured workers to adopt sound financial planning strategies to manage expenses and maintain a secure future. This guide aims to provide a comprehensive insight into financial planning tailored specifically for injured workers, ensuring peace of mind during recovery.

Understanding Your Financial Situation

An essential first step in financial planning is understanding your current financial state. This involves:

- Assessing Income and Expenses: Start by listing all sources of income, including workers’ compensation, disability benefits, or savings. Compare this against your essential expenses such as housing, food, and medical costs.

- Creating a Budget: Establish a realistic budget that reflects your new financial situation. Prioritize necessary expenses and identify areas where you can reduce spending.

Utilizing Available Resources

Several resources and programs are available to support injured workers financially:

- Workers’ Compensation: Ensure you are receiving your entitled benefits. This coverage typically includes medical expenses and a portion of lost wages.

- Disability Benefits: If eligible, apply for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) to supplement your income.

- Community Resources: Local non-profits and government agencies may offer financial assistance or counseling.

Building a Financial Safety Net

Creating a financial cushion can help mitigate future setbacks:

- Emergency Savings Fund: Aim to save 3-6 months’ worth of living expenses. Small, regular contributions can add up over time.

- Insurance: Consider purchasing short-term or long-term disability insurance if you plan to return to the workforce. Health and life insurance are also essential components of a robust financial plan.

Debt Management Strategies

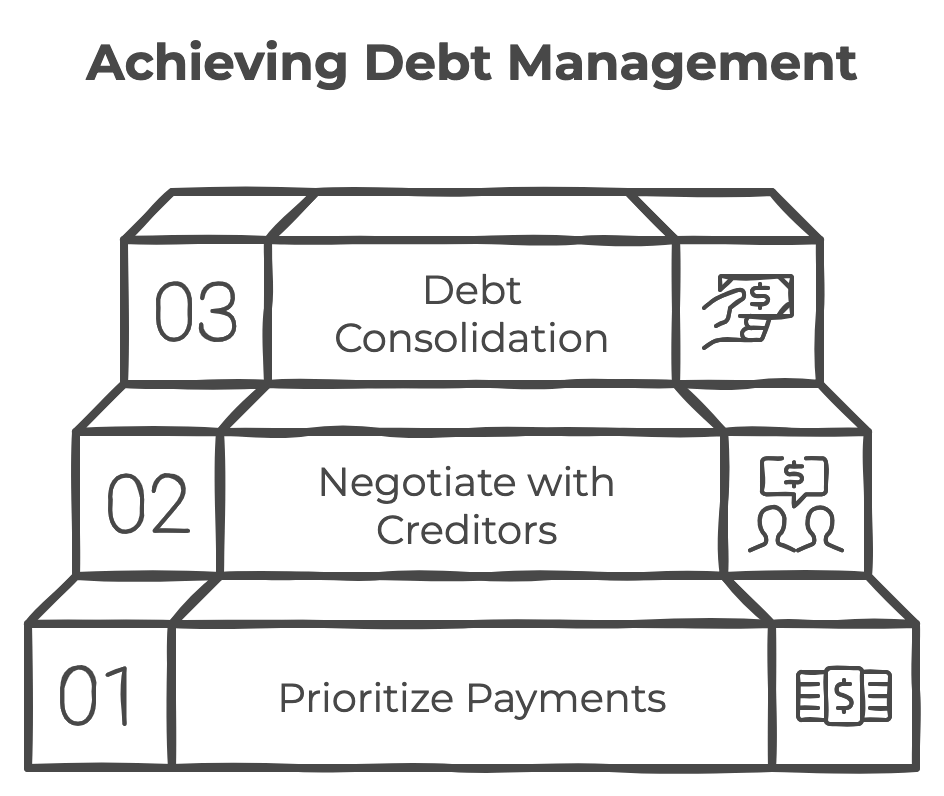

Managing debt efficiently is crucial to minimizing financial stress:

- Prioritize Debt Payments: Focus on high-interest debts first, such as credit cards. Minimum payments should be maintained on all accounts to avoid penalties.

- Negotiate with Creditors: Many creditors offer hardship programs or repayment plans tailored to your situation.

- Debt Consolidation: Explore consolidating debts into a single loan with a lower interest rate, simplifying payments and potentially reducing costs.

Planning for the Future

Despite current challenges, planning for long-term financial goals remains important:

- Retirement Planning: Keep contributing to a retirement account, if possible, even if contributions are modest.

- Investment Strategies: Consult a financial advisor to understand investment opportunities that align with your risk tolerance and goals.

- Estate Planning: Ensure you have up-to-date wills or trusts. Consider appointing a power of attorney for financial matters.

Conclusion

Effective financial planning is crucial for injured workers to navigate through and beyond periods of financial uncertainty. By understanding your financial situation, utilizing available resources, building a financial safety net, managing debt, and planning for the future, you can safeguard your financial health. Remember, seeking professional financial advice tailored to your specific needs can be a valuable step towards securing your financial well-being.